Why Agility Beats Accuracy in Volatile Markets

When Microsoft bundled Teams with Office 365 in March 2017, they didn't wait for perfect market research or competitor analysis. They acted on directional insight: remote collaboration was the future. Meanwhile, slack with superior features and user experience continued perfecting their product. The result? Teams captured 320 million users by 2024 while Slack plateaued at 65 million. This isn't a story about better technology winning; it's about agility trumping accuracy when markets move fast.

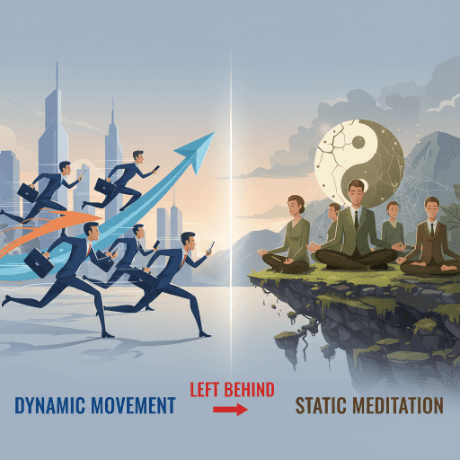

Visual representation of the agility vs accuracy dilemma in business decision-making

For B2B decision-makers operating in today's volatile environment, the Microsoft-Slack dynamic reveals a fundamental truth: perfect information is incompatible with perfect timing. While your competitors analyze, you have a window to act. The question isn't whether your decision will be flawless it's whether waiting for perfection will cost you the market.

The Accuracy Delusion: Why Perfect Data Leads to Perfect Failure ?

Analysis paralysis isn't just inefficiency its strategic suicide in volatile markets. When B2B leaders chase comprehensive data before acting, they unknowingly surrender competitive advantage to more agile competitors who understand that "good enough" insights combined with execution speed beat perfect analysis every time.

Consider the current SaaS market reality: aggregate quarterly net new ARR additions dropped 29% year-over-year in Q1 2025, with extreme volatility between quarters from +50% growth in Q2 2024 to -29% crash by Q1 2025. In this environment, companies clinging to traditional planning cycles find themselves consistently behind the curve.

The psychology behind accuracy obsession reveals the trap: anxiety about making wrong choices paradoxically leads to the worst choice of all inaction. While you're perfecting your fifteenth market analysis, agile competitors are capturing market share with solutions that solve customer problems adequately rather than perfectly.

Decision-making pathways in volatile business environments

The B2B software landscape exemplifies this dynamic. Only 40% of supply chain organizations are using generative AI to improve operations, yet top-performing companies adopt AI and machine learning at more than twice the rate of lower-performing peers. The leaders aren't waiting for perfect AI implementation they're iterating their way to competitive advantage.

The Microsoft Teams Masterclass: Agility Over Perfection

Microsoft's Teams victory represents the definitive case study in strategic agility. When the pandemic accelerated remote work adoption, Microsoft didn't conduct extensive feature comparisons or user experience studies. They leveraged their existing Office 365 infrastructure and moved decisively.

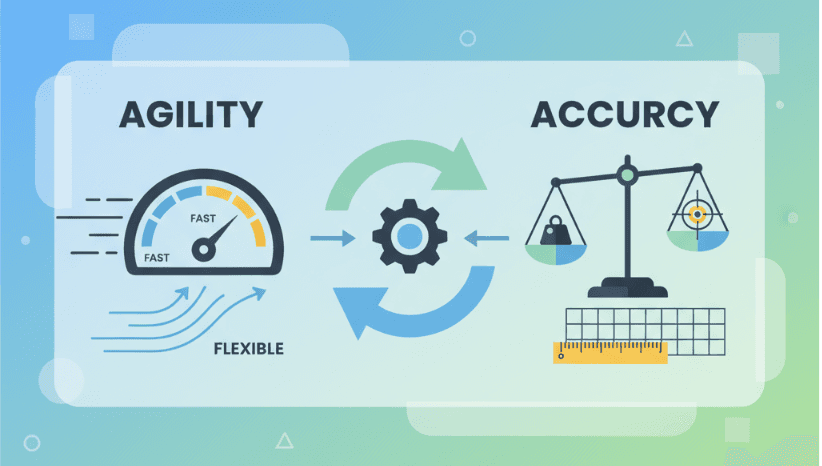

Microsoft Teams vs Slack: How Agile Strategy Won the Market

The numbers tell the story of agile execution: Teams grew from 2 million users in 2017 to 320 million by 2024, while Slack's more measured approach yielded growth from 6 million to 65 million users over the same period. Microsoft understood that market timing beats product perfection when disruption creates opportunity windows.

Slack's superior user experience and innovative features couldn't overcome Microsoft's bundling strategy and ecosystem integration. Teams succeeded not because it was better, but because Microsoft acted faster on the fundamental shift toward integrated collaboration platforms.

This dynamic extends across B2B markets. Leading firms embedding adaptive pricing strategies respond to cost fluctuations in days while competitors remain trapped in quarterly negotiation cycles, losing both margin and credibility with each delayed response.

The Volatility Advantage: Why Uncertainty Favors the Swift

Volatile markets create asymmetric opportunities for agile decision-makers. Business volatility has risen 183% over four years, but this instability punishes slow-moving organizations while rewarding those that embrace continuous adaptation using technology, data and AI.

AI-driven trading exemplifies this principle: hedge funds using AI algorithms can process Federal Reserve meeting minutes and generate trading signals faster than human analysis, with equity prices now moving more consistently in directionally correct patterns within 15 seconds of information releases. The speed advantage compounds over time, creating insurmountable competitive gaps.

B2B companies targeting volatile markets have learned similar lessons. Seventy-five percent of buyers will change suppliers for superior online experiences, creating opportunities for agile companies to capture business from slower-moving incumbents focused on internal perfection rather than customer problem-solving.

The 80/20 Decision Framework: Optimizing Impact Under Uncertainty

Effective agile decision-making requires structured approaches that maximize speed without sacrificing strategic thinking. The most successful B2B leaders implement the 80/20 principle: focus on the 20% of information that drives 80% of decision impact.

Jeff Bezos's "Type 1 and Type 2 Decisions" framework provides practical guidance: Type 2 decisions (reversible) should be made quickly with available data, while Type 1 decisions (irreversible) warrant deeper analysis. The key is correctly categorizing decisions rather than treating every choice as irreversible.

Three Implementation Strategies:

Decision Timeboxing

Establish maximum analysis periods based on decision reversibility and market velocity. Use frameworks like RAPID (Recommend, Agree, Perform, Input, Decide) to align stakeholders within defined timeframes rather than endless iteration cycles.

Iterative Market Entry

Deploy minimum viable solutions that can be refined based on customer feedback. This approach enables rapid market positioning while maintaining quality through continuous improvement cycles rather than pre-launch perfection.

Real-Time Intelligence Systems

Implement monitoring for key market indicators, customer behavior shifts and competitive responses. The goal is detecting directional changes early enough to respond before competitors, not comprehensive market mapping.

The Strategic Imperative: Building Organizational Velocity

In markets where 88% of business leaders anticipate even faster change rates, organizational agility becomes the core competitive differentiator. Companies that master continuous reinvention using AI and data position themselves to capture opportunities while competitors remain paralyzed by uncertainty.

The B2B SaaS sector provides compelling evidence: despite economic headwinds, the category achieved 19% annual growth in 2023, with hypergrowth companies in BCG's sample achieving 187% growth. These leaders succeeded not through perfect market predictions, but by rapidly adapting to customer needs and market conditions.

Four Critical Capabilities:

Speed-to-Insight: Deploy AI and predictive analytics to accelerate decision-making processes while maintaining directional accuracy.

Execution Velocity: Build systems for rapid solution deployment and iteration based on market feedback rather than theoretical perfection.

Adaptive Pricing: Implement dynamic adjustment mechanisms that respond to market conditions in real-time rather than annual planning cycles.

Competitive Intelligence: Establish real-time monitoring of market shifts and competitor moves to identify opportunity windows before they close.

The Choice: Action or Obsolescence

Your competitive advantage lies not in avoiding wrong decisions, but in making course corrections faster than competitors paralyzed by accuracy pursuit. In volatile markets, the cost of waiting for perfect information consistently exceeds the risk of directionally correct action.

The SaaS market's extreme quarterly volatility swinging from +50% growth to -29% decline within months demonstrates that traditional planning approaches are obsolete. Organizations that thrive will be those mastering intelligent speed over perfect accuracy.

The Microsoft Teams victory wasn't about superior features it was about recognizing market direction and acting decisively. While Slack perfected user experience, Microsoft captured the market through strategic bundling and rapid execution.

Every day spent seeking perfect accuracy is another day your agile competitors gain irreversible market advantages. The question isn't whether you can afford to act on imperfect information, it's whether you can afford not to.

In volatile markets, agility doesn't just beat accuracy, it determines survival. The organizations dominating the next decade will be those that embrace the strategic advantage of intelligent speed, making directionally correct decisions quickly and adapting based on market feedback.

The market rewards movement, not meditation.

Act now, refine later, and let your competitors perfect themselves into irrelevance.